Congratulations — you received an offer on your home! This is an exciting step, but it can also feel overwhelming if you are selling on your own. What happens next?

This guide will walk you through each step after receiving an offer so you can move forward with confidence. At the end, you will also find a helpful glossary of key terms.

1. Forward the Offer to Us

If you received the offer directly, send the complete document to [email protected] right away. We will do a basic review for accuracy and potential red flags (this is not legal advice).

For legal questions, negotiation strategies, or liability issues, consult with a real estate attorney.

2. Review the Offer Carefully

Even if we have already looked at it, you should review the offer thoroughly. Pay close attention to:

➝ Purchase price

➝ Contingency periods (loan, inspection, appraisal, or sale of buyer’s property)

➝ Requested inclusions or exclusions (appliances, fixtures, etc.)

➝ Credits or concessions (these affect your bottom line or appraisal)

➝ Proposed closing date

➝ Earnest money deposit

➝ Early or post-occupancy requests (these carry risks)

➝ Buyer agent commission

📍 Florida properties only: We recommend using Your Title Group for closing. They understand FSBO priorities — low cost, clear communication, and excellent service. Contact them promptly and note on the first page of your contract that they (or the title company of your choice) will handle the closing.

Your Title Group Contact:

📧 [email protected]

📞 407-982-7261

🏢 12301 Lake Underhill Rd. Suite 213, Orlando, FL 32828

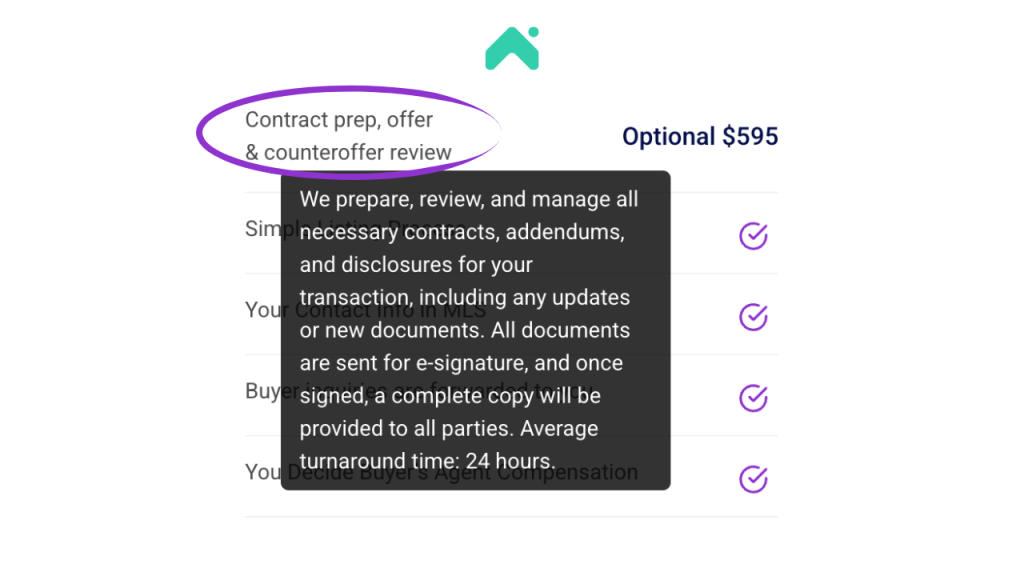

3. Consider Upgrading to Contract Preparation & Review

Our Contract Preparation & Review (CP&R) service gives you peace of mind that all paperwork is correct. It includes:

- Preparation and review of contracts, addendums, and disclosures

- Updates or new documents during the closing process

- E-signature coordination for all parties

- Complete copies of every signed document

This service is available for any offer you receive. You can upgrade directly from your Dashboard → Upgrade Your Listing.

4. Responding to the Offer

Once you review the offer, you have three options:

➝ Accept the offer as written

➝ Counteroffer by either using a Counter Offer Form or marking changes directly on the contract (make sure you initial all changes)

➝ Reject the offer outright

⏰ Be mindful of response deadlines. A buyer can withdraw their offer if you do not reply in time.

Remember, a counteroffer legally becomes a new offer that the buyer can accept, reject, or counter again. Respond quickly to keep negotiations moving.

Not responding at all is considered a rejection. We recommend acknowledging every offer, even if you decline.

5. Buyer Opens Escrow

Once an offer is accepted:

- The buyer deposits earnest money (a good-faith deposit). Make sure both you and List With Freedom receive written confirmation of this deposit.

- Escrow is opened, and timelines begin for inspections and contingencies.

6. Stay on Top of Contingencies and Deadlines

Contingencies are protections for the buyer and include deadlines. Common ones include:

- Inspection: Buyers may request repairs or credits.

- Appraisal: The property must appraise at or above the purchase price for lender approval.

- Financing: The buyer must secure loan approval.

- Sale of Buyer’s Property: Buyer must sell their current home first.

Keep track of these timelines. Missing a deadline could put your contract at risk.

7. Keep Records Organized

Save copies of all offers, counteroffers, and correspondence. Send any signed or updated documents to us so we can update your listing file.

Keeping us updated ensures MLS compliance and protects you if questions arise later.

8. Prepare for Closing

As you approach closing:

➝ Complete any agreed-upon repairs

➝ Watch for communication from escrow or title regarding:

- Signing documents

- Final walkthrough

- Settlement statements and fund transfers

9. Close and Celebrate 🎉

Once funds are transferred and documents are recorded, your sale is complete. You will receive confirmation and closing documents for your records.

And as promised, here’s a quick glossary to help you understand some of the most common terms you’ll see in an offer.

Whether you’re reviewing your first contract or your fifth, these definitions will give you clarity and confidence as you move through the process…

Addendum

A separate document attached to the contract that modifies or adds to the original agreement. Must be signed by all parties to be valid.

Appraisal

An independent professional estimate of your property’s market value. Required by most lenders to ensure the loan amount is in line with the property’s worth. This is typically the buyer’s expense.

Buyer Agent Commission

The fee paid to the buyer’s real estate agent, typically a percentage of the sale price. This can be negotiated as part of the offer and is not required by the seller. Always double-check this number in the contract. If it’s higher than expected, it reduces your net proceeds.

Closing (Settlement)

The final step in the sale where documents are signed, funds are transferred, and ownership is legally recorded.

Closing Costs

Expenses paid at closing, which may include title fees, escrow fees, recording fees, and taxes. Both buyers and sellers may have closing costs.

Concessions (Credits)

Money or cost reductions the seller agrees to cover, often applied toward the buyer’s closing costs, buyer’s agent commission, or repairs. Large concessions may reduce your net proceeds or affect loan approval if they exceed limits.

Contingency Periods

Deadlines built into the contract that give buyers time to complete certain steps before being fully committed. Until these deadlines pass, buyers may have the right to cancel without penalty. Examples include:

1, Inspection: Buyer can hire an inspector and request repairs or credits.

2. Appraisal: Lender confirms the property’s value supports the loan.

3. Financing: Buyer must secure loan approval.

4. Sale of Buyer’s Property: The buyer’s purchase is contingent upon them selling their own property first. This adds uncertainty, as delays in their sale can delay or even jeopardize the transaction. If possible, consider limiting the time frame for the contingency or assessing the buyer’s ability to fulfill it quickly.

4. Counteroffer: A response to an offer where terms are changed (such as price, dates, or repairs). This legally creates a new offer.

Early/Post-Occupancy Requests

- Early occupancy: Allowing the buyer to move in before closing can lead to significant risks. Issues could arise if the sale falls through, as you’d then have to legally remove the occupant. Additionally, any damage occurring during this period could become a point of dispute.

- Post-occupancy: This involves the seller staying in the home for a set period after closing, which can lead to potential liability issues or disagreements about property conditions.

Both should be approached with caution and clear written agreements.

Earnest Money Deposit (EMD)

A “good faith” deposit the buyer provides after the offer is accepted, typically held in escrow. It shows the buyer is serious and provides some security if they back out without a valid reason. Larger deposits may indicate stronger commitment.

Escrow

A neutral third party that holds funds and documents until all conditions of the sale are met. Escrow ensures both buyer and seller meet their obligations.

Fixtures

Items attached to the property (like built-in appliances, lighting, or ceiling fans). Unless excluded in the contract, fixtures are assumed to stay with the property.

Inclusions/Exclusions

Personal property or items the buyer requests to stay (inclusions) or that the seller specifies will not stay (exclusions). Examples: appliances, curtains, or outdoor furniture. Be sure to review this list very carefully so there is no dispute at closing.

Occupancy (Early or Post)

When a buyer requests to move in before closing (early) or a seller requests to stay after closing (post). These carry risks and should be carefully reviewed.

Proposed Closing Date The day ownership officially transfers. This date should work with your moving plans and give enough time to prepare for closing. If it’s too soon or too far away, you can counter with a more suitable date.

Purchase Price

The amount the buyer agrees to pay for the property, as stated in the contract.

Settlement Statement (Closing Disclosure)

The detailed document showing all financial aspects of the transaction, including purchase price, credits, fees, and final amounts due.

Title Company A company that verifies legal ownership, issues title insurance, and often manages the closing process.

Timelines/Deadlines

Specific dates in the contract for completing tasks (like inspections, loan approval, or closing). Missing a deadline can cancel the contract.

Wrapping It Up 🎉

Receiving an offer is a big milestone, but it’s only the beginning of the process. From reviewing the fine print to staying on top of deadlines, each step matters in protecting your deal and making sure your sale closes smoothly.

The good news? You don’t have to navigate this alone. Our team is here to guide you, answer questions, and keep your listing file compliant so everything moves forward without surprises.

Stay organized, stay confident, and keep moving forward. You’ve already done the hardest part: attracting a buyer. Now it’s time to see your sale through to the finish line.

And remember, if you ever have questions or feel unsure about any part of the process, don’t hesitate to contact us.

Next Steps:

➝ Explore our pricing plans

➝ Learn how it works

➝ Contact us today to get started

Other Blogs You Might Find Helpful:

➝ Flat Fee vs. Full-Service Realtor: Which is Right for You?

➝ What Is a Flat Fee MLS Listing? A 2025 Guide for FSBO Sellers

➝ Why More Homeowners Are Choosing FSBO in 2025

➝ What to Do After You Get an Offer on Your Home

➝ Contingencies in Real Estate: A Simple Guide for Sellers

➝ How to Prevent Title Issues From Delaying Your Home Sale

➝ Should You Stage Your Home Before Listing? Pros & Cons

➝ How to Handle Multiple Offers Without an Agent

➝ How to Respond to Lowball Offers When Selling FSBO

➝ Fastest Way to Sell a House By Owner in 2025